IGTO report into the Exercise of the Commissioner’s General Powers of Administration is released publicly

Aiming to improve general tax administration via certainty, accountability and transparency

The report of the Inspector-General of Taxation and Taxation Ombudsman’s (IGTO) investigation into The Exercise of the Commissioner’s General Powers of Administration has been publicly released.

‘The report examines an important area of tax administration,’ said Karen Payne, the IGTO. ‘Although many unremarkable decisions and actions are made or taken every day by Tax Officials in reliance on the Commissioner’s general powers of administration (GPA), a number of significant decisions and actions are also made by the Commissioner (or his delegate, or duly authorised tax official) in reliance on the GPA as part of his administration of the tax system.’

Ms Payne observed that most tax legislation includes a provision which states that the Commissioner shall have the general administration of the Act.

“Despite its broad application and usage in tax administration, the legislation does not define or describe the purpose, nature or scope of the GPA,” Ms Payne said. “Our view is it would improve certainty, accountability and transparency and thus benefit Australian taxpayers if it did.”

Context for the review of GPA

The Australian Administrative Law Policy Guide issued by the Attorney-General’s Department provides some important context for the review of this administrative power. The Policy Guide states that:

Administrative power that affects rights and entitlements should be sufficiently defined to ensure the scope of the power is clear.

Some significant tax decisions made in reliance on GPA

Some of the significant areas of the tax system administered in reliance on GPA include:

- settlement of tax disputes;

- compromise of tax debts;

- development of practical compliance guidelines;

- administering tax laws following significant judicial decisions;

- implementing aspects of the Government’s coronavirus economic support measures; and

- implementing a shortcut deduction method for working from home expenses during the COVID-19 pandemic. – see Slide 3

Limited avenues for challenges

“It is important to note that there are limited avenues for taxpayers and tax practitioners to challenge an exercise of the Commissioner’s GPA,” Ms Payne said. “Decisions made under the GPA are not specifically reviewable and are largely not otherwise reviewable by the Courts. In many cases, GPA decisions and actions appear to be exercised by tax officials on behalf of the Commissioner, without written delegation or authorisation. Rather they seem to be exercised as a matter of implied authority, without an objective or principled framework but simply as a matter of individual judgment.” – see Slide 4

IGTO review investigation of GPA

The IGTO commenced this review investigation following observations made in a number of complex dispute investigations in which the Australian Taxation Office (ATO) applied the GPA as part of its administrative actions and decisions. The review investigation examined a broad range of research and other materials, and consulted widely with current and former senior officers of the ATO, academics and leading tax practitioners and professional bodies about their understanding of the GPA and what it encapsulates.

Karen Payne said: “We would also highlight that through this research and consultation, the IGTO has observed that there is no universal understanding of the GPA. Furthermore, there is a lack of clarity about the nature and objective of the GPA. In particular, the IGTO considers that it is unclear as to whether the GPA simply imposes a duty upon the Commissioner which carries with it no additional administrative discretions – or whether it is a power in its own right to allow the Commissioner to administer the tax laws as enacted by Parliament in a sensible and practicable manner.”

Five case studies

The report examines the use of the GPA through the lens of five case studies that serve to illustrate the complexities of the GPA, often in the absence of a clear framework for decision-making. The case studies highlight a number of conceptual and practical challenges with the GPA including that:

- the Commissioner’s exercises of the GPA are generally not able to be challenged in the Administrative Appeals Tribunal or the Federal Court of Australia, and so taxpayers have little recourse where the exercise of the GPA adversely impacts them;

- unlike other jurisdictions and other statutory regimes in Australia, there is no statutory framework to guide the exercise of the GPA in Australia;

- it is often difficult to delineate what aspects of the ATO’s actions or decisions are made under the GPA and what aspects are pursuant to express statutory provisions or discretions;

- the exercise of the GPA may include the introduction of parameters or thresholds as part of decision making which necessarily exclude those that do not come within the set parameters; and

- exercises of the GPA may result in taxpayers in materially similar circumstances being treated differently or inconsistently.

Settlement decisions

The experience in dispute investigations contrasts with an exercise of the Commissioner’s GPA in the context of settlements where:

- There is an express delegation to persons in the position of Second Commissioner and SES Officers;

- The exercise of the GPA is therefore governed by an Instrument of Delegation, as well as various guidance material and instructions which set out relevant criteria to be considered:

- PSLA 2015/1 Code of Settlement;

- A Practical Guide to the Code of Settlement;

- PSLA 2007/6 – Guidelines for Settlement of widely based tax disputes;

- PSLA 2009/9 – Conduct of ATO litigation and engagement of ATO dispute resolution;

- 2011/7 – Settlement of debt litigation proceedings.

- The ATO publishes details of settlements entered and variances annually in their Annual report;

- Some ATO settlement decisions are overseen by an internal panel or assured by an external review:

- A Widely-based Settlement Panel (the Panel) has been established to provide advice to decision-makers about offers and proposals to settle widely-based tax disputes involving at least 20 taxpayers

- Independent Assurance of Settlements Program – which was implemented in 2016, where one of 5 retired Federal Court judges review and advise on the ATO’s largest and most significant settlements. – see Slides 5 – 7

The IGTO supports the flexibility that the GPA affords the Commissioner to achieve sensible and practicable outcomes for taxpayers as part of his or her administration of the tax system. However, the IGTO considers that the administration of the tax system and the taxpayer’s experience when engaging with the tax system would be enhanced through the implementation of a principled framework to guide decision making under the GPA.

Recommendations

The report makes six recommendations, which are set out in full in Annexure A. Three (3) recommendations are for the ATO and three (3) are for Government – see Slides 20 – 26 … but these are prefaced with an overarching Primary Observation – see Slide 9. That is, before implementation of the recommendations are considered, steps should be taken to clarify whether the GPA is intended to act only as a duty upon the Commissioner or whether it is a power. The clarification could take a number of forms, including through legislation, judicial clarification or by the Executive through a Statement of Expectations.

The ATO has agreed with all three recommendations made to it. These recommendations aim for administrative improvements by enhancing education and awareness of the GPA, significant decisions that rely upon the GPA and reporting of significant exercises of the GPA.

The IGTO has also made three recommendations to the Government. These recommendations are aimed at establishing a principled framework to guide tax administration (decisions and actions) through the exercise of the GPA. This framework is considered analogous to provisions found elsewhere both internationally and domestically.

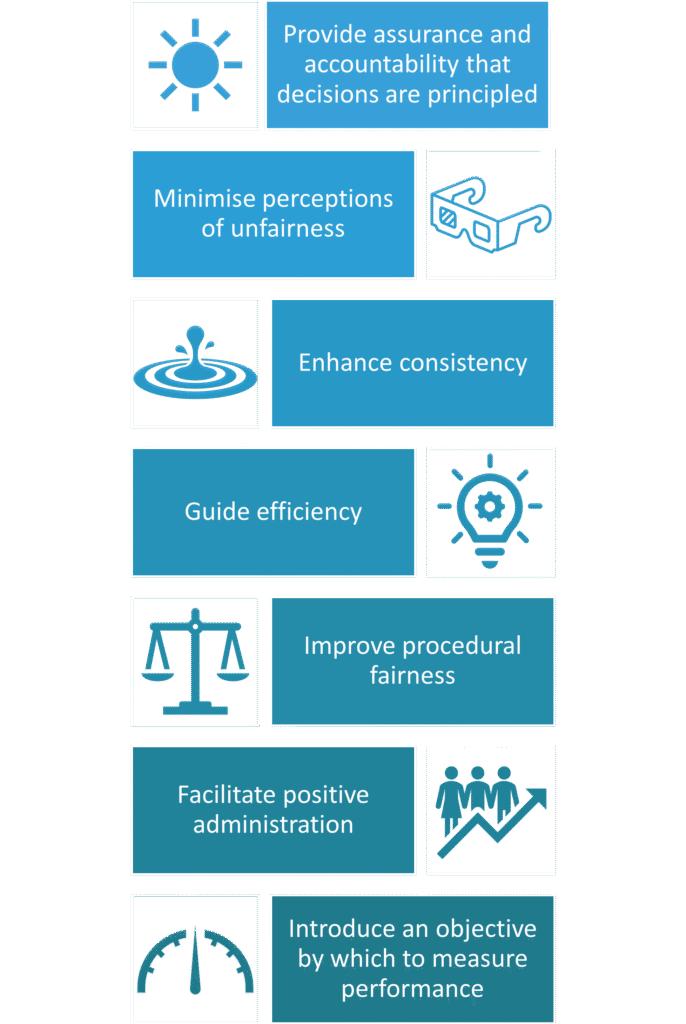

The IGTO considers a principled framework would provide the following benefits to improve general taxation administration – see Slides 27 – 31:

- Provide assurance and accountability that decisions are principled;

- Minimise perceptions of unfairness;

- Enhance consistency;

- Guide efficiency;

- Improve Procedural Fairness;

- Facilitate Positive administration;

- Provide an objective by which to measure performance;

Further recommendations suggest developing a standard suite of discretions to allow the Commissioner to administer taxation laws in a manner that assists taxpayers and which would apply in all cases unless expressly excluded by Parliament and enhancing overall reporting of significant GPA decisions.

Call for transparent and fairer outcomes

Ms Payne said: “The implementation of these recommendations would improve the tax administration system by allowing more transparent and fairer outcomes for taxpayers and tax practitioners while also ensuring that ATO decision-making is consistent, efficient and effective to achieve the intended purpose of legislation as enacted by Parliament. This would enhance the accountability of decision making and the overall integrity of the tax system.”

These features and qualities are recognised as important in administrative law design generally and tax administration design internationally, since:

Taxpayers who are aware of their rights and expect, and in fact receive, a fair and efficient treatment are more willing to comply.

About the IGTO

The Inspector-General of Taxation and Taxation Ombudsman (IGTO) is an independent, Commonwealth statutory agency, established in 2003. The Taxation Ombudsman function was transferred to the IGTO in 2015. The IGTO provides an important safety net service in the tax system. Independent investigation of taxpayer complaints enhances community confidence in the fairness of the tax system and provides assurance to taxpayers in the fairness of their outcomes. This helps to enhance voluntary compliance. The IGTO also provides independent advice and assurance to Government on the taxation administration laws and systems. Since 2015, the IGTO has performed dual roles, which complement each other:

- The Taxation Ombudsman provides independent assistance and assurance directly to taxpayers and tax professionals and investigates taxation complaints about the actions and decisions of the Australian Taxation Office (ATO) or the Tax Practitioners Board (TPB). The Taxation Ombudsman, also conducts investigations of actions that have broader community impact or are commonly observed in a number of complaints to identify wider system improvements that address the causal issues.

- The Inspector-General of Taxation undertakes investigations of actions, systems and taxation laws (to the extent they deal with tax administration matters).

Annexure A – Primary Observation and Recommendations

Observation – Administrative Duty or Power?

The Inspector-General of Taxation and Taxation Ombudsman observes that it is not clear whether the Commissioner’s GPA is simply a duty (which carries no administrative discretion) or if it is a power.

Consistent with the Australian Administrative Law Policy Guide, it would be useful to clarify if the Commissioner’s GPA is simply a duty (which carries no administrative discretion) or if it is a power and if a power, the limits of that power to administer the tax and superannuation laws practically and pragmatically.

Accordingly, the recommendations made in this report would be supported and enhanced by clarification about the nature and intended purpose of the Commissioner’s GPA.

Whilst several means of clarification are available, Executive clarification (e.g., via a Statement of Expectation) or Legislative clarification would provide the highest levels of certainty for the community.

Recommendation 1

The IGTO recommends that the ATO consider establishing an advisory or oversight panel to assist and guide broad reaching exercises of the Commissioner’s GPA – that is, where such exercises are likely to impact large sections of the taxpayer population.

ATO Response – Agree

Recommendation 2

The IGTO recommends that the ATO consider ways in which it could raise awareness and understanding of the Commissioner’s general powers of administration, including by considering whether PSLA 2009/4 remains fit for purpose and any additional guidance that may be developed to support greater (public and tax official) understanding of the GPA.

ATO Response – Agree

Recommendation 3

The IGTO recommends that the ATO consider ways in which it could enhance accountability and transparency for broad reaching exercises of the Commissioner’s GPA and to enable taxpayers to more easily identify and track exercises of the GPA that may affect them.

This recommendation is related to Recommendation 6.

ATO Response – Agree

Recommendation 4

The IGTO recommends (for the reasons set out in Chapter 5) that the Government consider enacting a framework of guiding principles for the exercise of the Commissioner’s GPA. Without prescribing what principles or factors should make up that framework, the IGTO provides, by way of example,, some principles which may be suitable to be included in the framework.

For example:

The Commissioner of Taxation shall exercise his powers of general administration in a way that is practicable and in accordance with the law and in furtherance of:

- fostering voluntary compliance and willing participation of all taxpayers within the tax and superannuation systems;

- minimising the cost of compliance for taxpayers to participate within the tax and superannuation systems;

- ensure that the resources of the ATO are applied to optimise compliance assurance and revenue collection;

- resolving disputes in a procedurally fair and proportionate manner having regard to the GPA principled framework;

- assisting taxpayers who make honest mistakes to correct their mistake where this assists to achieve outcomes and results as intended by specific measures;

- promoting fairness in all the circumstances; and

- respecting the requirements of procedural fairness.

ATO Response – This is a matter for Government

Recommendation 5

The IGTO recommends that the Government consider improving tax administration by providing the Commissioner with an express administrative discretion, unless expressly excluded by Parliament (i.e. the legislation may expressly prevent the discretion from applying), to:

- alter any procedural requirement in the interests of reducing compliance costs for taxpayers;

- allow taxpayers to correct an honest and reasonable mistake or error in any lodgement or filing for the purposes of a taxation law or to withdraw an erroneous form or application and resubmit a corrected one;

- extend the time for a taxpayer to exercise their rights, apply for access to support or provide further or additional information in support of such an application; and

- suspend a penalty subject to certain conditions which promotes future voluntary compliance (including for example, a named period of demonstrated compliance).

ATO Response – This is a matter for Government

Recommendation 6

The IGTO recommends that the Government consider improving tax administration by legislating a requirement for the Commissioner to annually publish and table a record of the exercises of his general powers of administration where it affects a broad class or broad range of taxpayers.

ATO Response – This is a matter for Government

Annexure B – Benefits of a Principled Framework for GPA decisions and actions

References

| ↑1 | Hutchins v Deputy Commissioner of Taxation (1996) 65 FCR 269 – If a decision is neither expressly nor impliedly required by an enactment and, although authorised, is authorised by an enactment only in a very general way, it is unlikely to have the character of a decision for which provision is made under an enactment. The connection between the text of the enactment and the decision is likely to be too remote for the decision to have the requisite character. |

|---|---|

| ↑2 | Under Part IVC of the Taxation Administration Act 1953 – for example, by objection. |

| ↑3 | See PSLA 2009/4 When a proposal requires an exercise of the Commissioner’s general powers of administration – which sets out the ATO internal procedure to escalate exercises of the Commissioners’ GPA to the Commissioner himself – paragraphs 5 and 8. |

| ↑4 | Refer PSLA 2007/6 paragraph 3 |

| ↑5 | https://www.ato.gov.au/General/Dispute-or-object-to-an-ATO-decision/In-detail/Avoiding-and-resolving-disputes/Settlement/Independent-Assurance-of-Settlements-program/ |

| ↑6 | See for example, New Zealand’s Tax Administration Act 1994 which includes obligations of care and management |

| ↑7 | See for example section 15-10 of the Australian Charities and Not-for-Profits Commission Act 2012 |

| ↑8 | Attorney-General’s Department, Australian Administrative Law Policy Guide (2011) pp 8 – 10. |

| ↑9 | Organisation for Economic Co-operation and Development, General Administration Principles – GAP001 Principles of Good Tax Administration [PDF 64.0KB] (21 September 2001) p 3. |